Get the free worksheet for determining support form

Show details

1 2 3 Lowell Finley, SON 104414 LAW OFFICES OF LOWELL FINLEY 1604 SOLANO AVENUE BERKELEY, CALIFORNIA 94707-2109 TEL: 510-290-8823 FAX: 510-526-5424 4 Attorneys for Plaintiffs and Petitioners 5 SUPERIOR

We are not affiliated with any brand or entity on this form

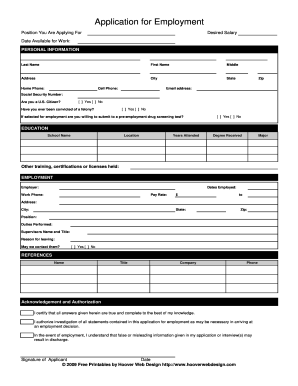

Get, Create, Make and Sign

Edit your worksheet for determining support form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your worksheet for determining support form via URL. You can also download, print, or export forms to your preferred cloud storage service.

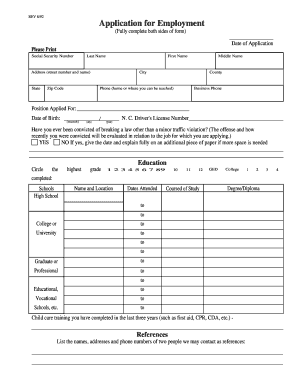

Editing worksheet for determining support online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit irs worksheet for determining support form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

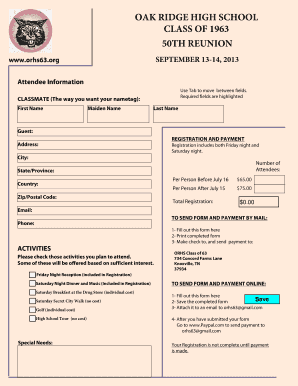

How to fill out worksheet for determining support

How to fill out worksheet for determining support?

01

Gather all relevant financial information, including income, expenses, and assets.

02

Complete all sections of the worksheet, providing accurate and detailed information.

03

Double-check all calculations and ensure that all necessary documents are attached.

04

Review the completed worksheet for any errors or discrepancies before submitting it.

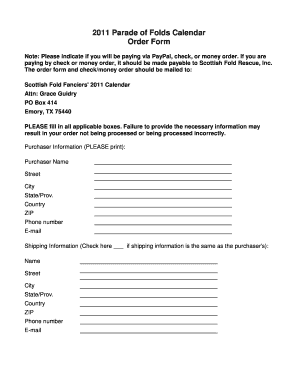

Who needs worksheet for determining support?

01

Individuals who are involved in a divorce or separation and need to determine spousal or child support.

02

Lawyers and legal professionals who are assisting their clients in calculating support payments.

03

Courts and judges who require the worksheet as a part of the legal process to determine support amounts.

Video instructions and help with filling out and completing worksheet for determining support

Instructions and Help about worksheet for determining support

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Who is required to file worksheet for determining support?

In the United States, any individual or couple filing for a divorce must file a worksheet for determining support. The worksheet should include information about incomes, expenses, debts, and assets for both parties. The worksheet is used to determine the level of spousal or child support that may be due.

How to fill out worksheet for determining support?

1. Gather all necessary information. This includes gathering your income information, the income information of your spouse, and any other relevant financial information, such as child support or alimony payments.

2. Calculate total combined income. Add up both incomes and subtract any applicable deductions to get the total combined income.

3. Calculate total child support obligations. This includes any child support payments that are currently being made, any child care costs, and any other expenses related to the children.

4. Calculate total spousal support obligations. This includes any alimony or spousal support payments that are currently being made.

5. Calculate total monthly expenses. This includes rent or mortgage payments, utilities, food, clothing, and any other necessary expenses related to the household.

6. Calculate total net income. Subtract the total monthly expenses from the total combined income to get the total net income.

7. Calculate the amount of support. Take the total net income and subtract the total child support obligations and the total spousal support obligations. This will give you the amount of support that is available for the custodial parent.

When is the deadline to file worksheet for determining support in 2023?

The deadline to file worksheets for determining support in 2023 is typically set by the court handling the case. Contact the court in your area for more information.

What is worksheet for determining support?

A worksheet for determining support is a document used to calculate the amount of financial support that a person is required or willing to provide for another individual. This could be used in various situations such as divorce or child custody cases to help determine child support or spousal support amounts.

The worksheet typically includes information such as the income and expenses of both parties, including their salary, wages, bonuses, and other sources of income. It may also include factors such as the number of children involved, their specific needs, health insurance expenses, and any child care or education costs.

Based on the provided information, the worksheet applies specific formulas or guidelines set by local laws or courts to calculate the appropriate amount of support that should be provided. This worksheet aims to provide a fair and reasonable determination of support based on the financial circumstances and needs of the parties involved.

What is the purpose of worksheet for determining support?

The purpose of a worksheet for determining support is to calculate the appropriate amount of financial support that an individual should provide to another individual or family for their basic needs. This is often used in the context of divorce or separation cases, where one party may be required to pay spousal support or child support. The worksheet helps to ensure that the support amount is fair and takes into consideration various factors such as income, expenses, and the number of dependents.

What information must be reported on worksheet for determining support?

When determining support, the following information must be reported on a worksheet:

1. Income: The income of both parents must be reported, including wages, salaries, bonuses, commissions, self-employment income, rental income, and any other sources of income.

2. Deductions: Allowable deductions must be reported, such as federal and state taxes, Social Security and Medicare taxes, mandatory retirement contributions, union dues, and health insurance premiums.

3. Custody and Visitation Schedule: Information regarding the custody and visitation schedule is necessary to calculate child support. This includes the number of overnights each parent has with the child.

4. Child Expenses: Child-related expenses, such as health insurance premiums, daycare expenses, and extraordinary medical expenses, should be reported.

5. Other Child Support Obligations: If either parent has other child support obligations from a previous relationship, it must be reported.

6. Additional Expenses: Any extraordinary expenses related to the child, such as educational expenses, extracurricular activities, or special healthcare needs, should be reported.

7. Deviation Factors: The presence of any deviation factors that may impact the child support calculation, such as the needs of the child, the parents' ability to pay, or any extraordinary circumstances, should be reported.

It is important to consult the specific child support guidelines in your jurisdiction for detailed information on what must be reported on the support worksheet, as the requirements may vary.

What is the penalty for the late filing of worksheet for determining support?

The penalty for late filing of a worksheet for determining support varies depending on the jurisdiction and the specific circumstances. Generally, it can include a range of consequences, such as fines, interest charges on unpaid support, suspension of driver's license, wage garnishment, liens on property, and even imprisonment in extreme cases of intentional non-compliance.

It is important to note that the specific penalties for late filing of a support worksheet may be outlined in the relevant laws and regulations of each jurisdiction. It is advisable to consult with a local attorney or legal expert to understand the specific penalties applicable in a particular area.

How can I get worksheet for determining support?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the irs worksheet for determining support form in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I make edits in household support worksheet without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your worksheet for determining support excel, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I complete fillable worksheet for determining support on an Android device?

On an Android device, use the pdfFiller mobile app to finish your worksheet for determining support example form. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your worksheet for determining support online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Household Support Worksheet is not the form you're looking for?Search for another form here.

Keywords relevant to instructions for worksheet for determining support form

Related to worksheet for determining support instructions

If you believe that this page should be taken down, please follow our DMCA take down process

here

.